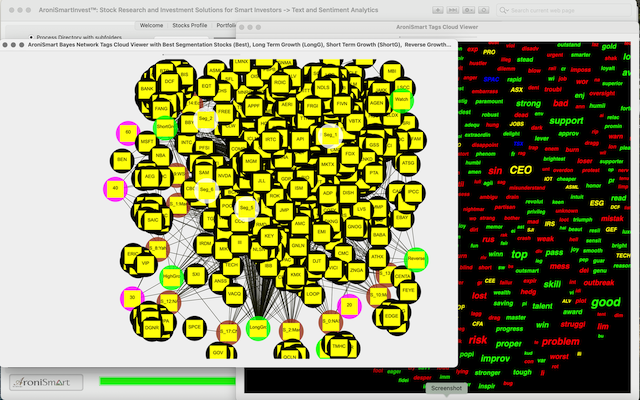

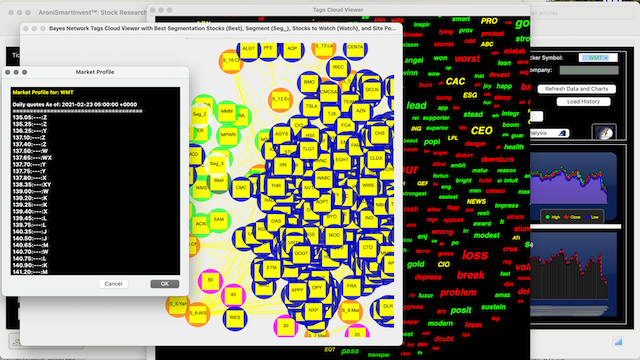

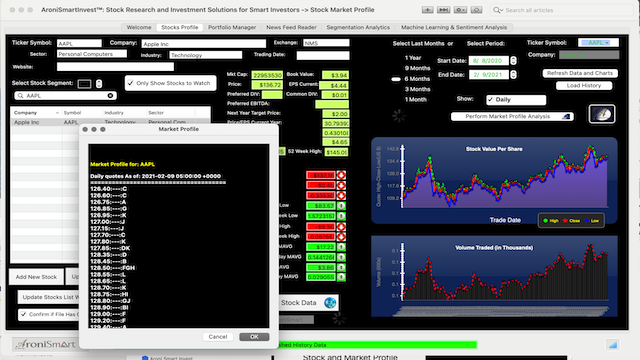

AroniSmartInvest™ in Action: Key Stocks on March 3, 2021; Machine Learning, Bayesian Network, Stock Segmentation, Market Sentiment Analyses

On March 3, 2021, the stock market continues to experience volatility similar to what was observed in February 2021 (see some dynamics here: AroniSmartInvest™ in Action: Key Stocks on Wild February 23, 2021; Machine Learning, Bayesian Network, Stock Segmentation, Market Sentiment Analyses) when the stock went on unpredictable drives and experienced wild days, apparently from a mix of speculative considerations, profit taking, increasing bonds prices, options trading, political negotiations, and news about some key stocks, especially those related to Electic Vehicules (EV), Technology. Several being impacted by unexplained or somewhat speculative actions.

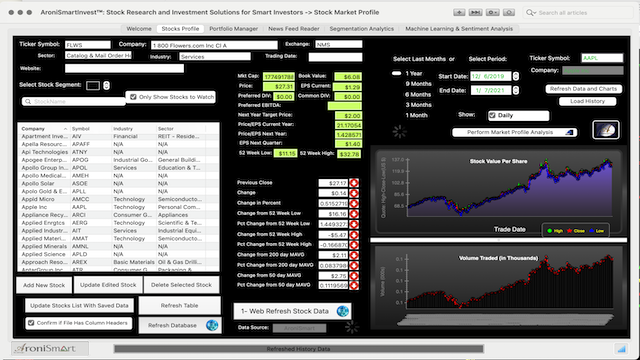

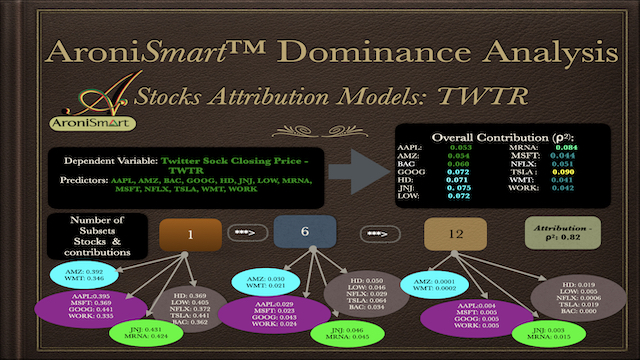

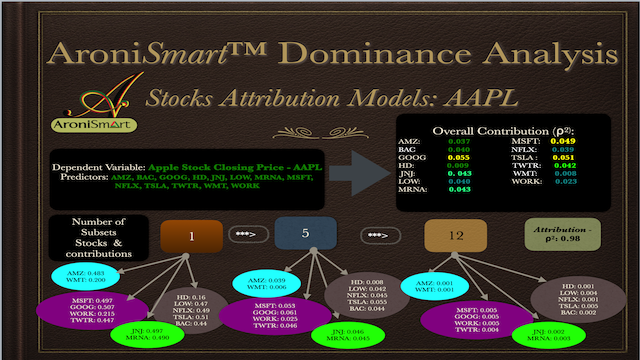

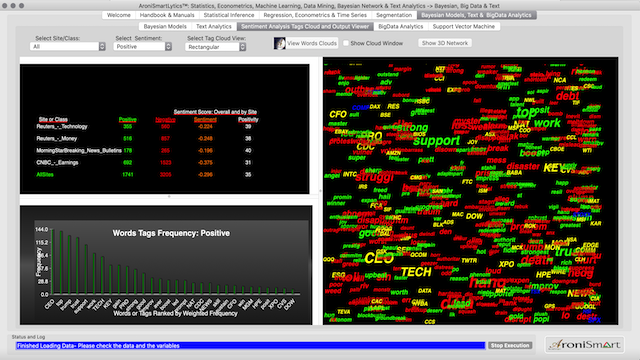

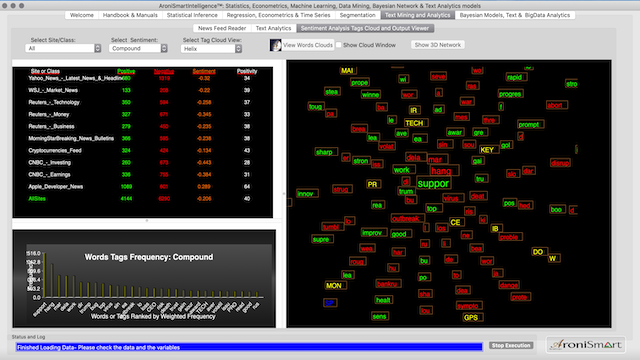

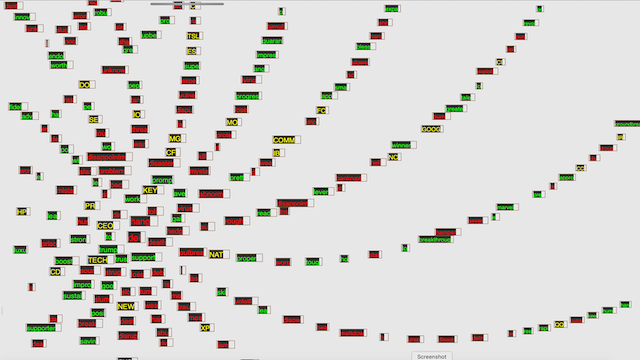

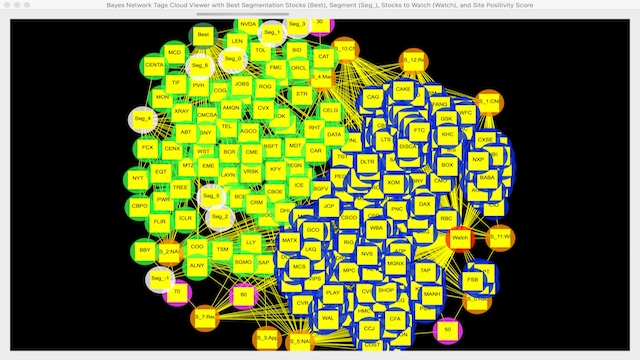

On March 3, the key stock market indices continued to register losses ( Dow Jones Industrial Average fell 0.4%, Nasdaq 2.7 %, S&P 500 1.3%). AroniSmart™ team, leveraging the Machine Learning, Big Data ,Bayesian Network Analysis, Neural Network Analysis, Text Analytics, and Sentiment and Valence Analysis capabilities of the new improved AroniSmartInvest™, looked at the stock performance, market sentiment index and events driving the stock market in early March 2021 ( For More on AroniSoft LLC and AroniSmart products click here).