In June 2017, AroniSmartInvest In Action, based on the analysis with AroniSmartInvest, predicted that Wal-Mart stock had started a momentum expected to accelerate for the rest of 2017 and 2018. AroniSmartInvest in Action projections were based on the several factors, that we will revisit shortly.

At the time, Wal-Mart stock (NASDAQ: WMT) had been soaring. June 2017 Year-to-date (YTD), the stock was up 15%, from $69.12 on Dec 30, 2016 to $79.36 on June 9, 2017 and 22% up since February 2017.

What happened then to the stock momentum.

Immediately after AroniSmartInvest team's predictions, the stock started a strong rally. By October 2017 it had rised to $88.48, or 17%. In November and December 2017, the stock reached $99.62 or 31% and by January 2018, it had peaked to $109.55 or 44%. It then, like the entire stock market, started a downward movement.

Today, it is at $88.00, or around 16% growth, since June 2017.

Analyzing Wal-Mart Stock Performance

With the performance, it is time to revisit the question asked then on where Wal-Mart was stock heading. AroniSmartInvest will then revisit the prospects for the stock in the short term and next year. AroniSmartInvest in Action gives hints based on AroniSmart stock segmentation and sentiment analytics.

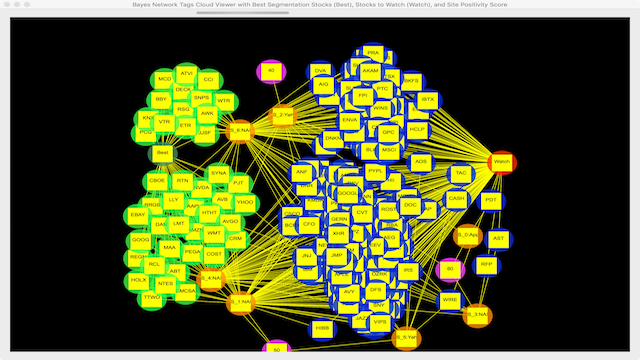

AroniSmartInvest In Action™ team has tried to look at the options, using AroniSmartInvest™ proprietary advanced analytics and machine learning algorithms combining stock segmentation and text and sentiment analytics (check the featured image to see Wal-Mart node in the AroniSmart network analytics). Stock segmentation in AroniSmartInvest™ combines both fundamentals and overall performance. Based on the results of segmentation, Wal-Mart stock has been, since last year, flagged among the stocks to watch.

The Segment in which Wal-Mart (WMT) stock has been classified includes the stocks with high EPS (earnings per share) and P/E (price-per earnings) ratios and a stable long term debt balance. Wal-Mart has currently P/E of around 29.32 and EPS of 3.00, down from an average of 4.5 in mid 2017. As predicted, it has distributed a dividend of $.51 in 2017 and $.52 in 2018.

What Wal-Mart has been up to?

Faced with stiff competition mostly from e-commerce, especially Amazon, Wal-Mart has been fighting back, and the market is responding well.

Wal-Mart' acquired Jet.Com after paying $3.3 billions to shore up its online strategy and presence (see our article: Wal-Mart Walking in Amazon Footsteps by acquiring Jet.com?).

The strategy took time, given the niche segment targeted by Jet.com and probably the slow technology integration.As Wal-Mart continues to expand its options to fend off competition from Amazon and other on-line retailers and to leverage its online strategy, the rewards are expected to grow.

To show its commitment to the online strategy, Wal-Mart has started to fully action a new delivery program. With the program, store workers fulfill and deliver some orders placed on Walmart.com or Jet.com. Since then, Wal-Mart has been expanding its online grocery delivery service, targeting close to 100 metropolitan areas by the end of 2018. More than 800 stores nationwide are fulfilling orders which are then being delivered to shoppers by drivers contracted through Uber, Deliv and other ride and delivery platforms.

If the program is fully implemented at all the 4,700 Wal-Mart US stores, Wal-Mart will be able to leverage its brick-and-mortar presence to shore up its on-line business. This presents an advantage over Amazon.com which only relies on on-line fulfillment.

Walmart did not stop there and joined forces with Microsoft in the fight against Amazon.

On July 17, Wal-Mart and Microsoft announced a five-year deal, under which Wal-Mart will boost the use of Microsoft's cloud services and help Wal-Mart to gain access to artificial intelligence and machine learning technologies to optimize energy consumption at stores and also help improve the delivery of on-line orders.

The agreement will help both Microsoft and Wal-Mart to take on their mutual strong competitor: Amazon.

Expanding Internationally and in Healthcare.

Walmart is also buying Flipkart, the India's leading online retailer for $16 billion for a controlling stake of 77%. The deal will increase WalMart e-commerce capabilities both in US and in India.

In April 2018, it was reported that Walmart was in talks to buy Humana, a healthcare company. This report followed a announcement by Amazon, Berkshire Hathaway and J.P. Morgan of a joint plans to improve the health care experience for their employees.

Will Wal-Mart catch up with Amazon?

Hence, it is clear that Wal-Mart has become very serious in challenging Amazon and is taking meaningful steps to do so. Will the stock market respond, accordingly? The stock market has been positively responding to Wal-Mart efforts since 2017. It is expected that the new steps taken by Wal-Mart are bringing it closer to face Amazon challenge with assurance. However, Amazon has a market valuation of $880B vs $260B for Wal-Mart. Hence, to match Amazon, Wal-Mart will need to grow its stock value close to 4 times. Will the steps taken help Wal-Mart to do it in the next few years?