On August 29, 2020, Apple's (NASDAQ:AAPL) and Tesla (NASDAQ: TSLA) stocks remain in the record high range, when Apple price reached $504.05 and its market capitalization increased to $ 2.135 trillion. Tesla price went up to $1,993.28. This string performance happened as for Apple (AAPL) and Tesla (TSLA) were getting ready for stock splits. The 4-for-1 stock split happenned on Monday August 31, 2020.

Immediately after the splits, the stocks for both Apple and Tesla shot up, respectively hitting $137.93 and $498.32. Then, something happened. By the end of the week, on Sep 4, 2020, the prices of the stocks of the 2 companies had significantly declined. Tesla stocks went from $498.32 to $418.32 or -16%. Apple stock declined from $134.18 to $120.96, or -10%. The question is now: what happened and what is likely to happen?

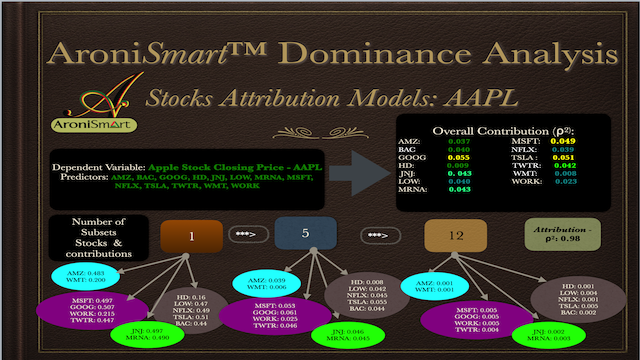

On July 18, 2020, AroniSmart™ team, leveraging the Machine Learning Time Series capabilities and Dominance Analysis of AroniSmartIntelligence™, looked at the trends of Apple Inc. (NYSE: AAPL) vs other 13 companies and came up with insights and projections on the dynamics (AroniSmart:AroniSmartIntelligence™ in Action: Apple (AAPL) Stock Performance Support Vector Machine and Dominance Analysis). In the analysis, stocks markets including Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Facebook (FB), Twitter (TWTR) and Tesla (TSLA) stock prices were connected. It appears that the stock market dynamics during the first week of Sept 2020 reconfirmed the analysis. The high prices from June to August 2020 led Apple and Tesla to consider stock splits, with the market expectation of setting new record highs.

Advertisement

GET ARONISMARTINTELLIGENCE on App Store

AroniSmartIntelligence, the leading tool for Advanced Analytics, Machine Learning & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.

In fact, all the stocks that in the analysis were connected to Apple dynamics, experienced heavy declines. Similar to Apple, most of the declines happened on Thursday Sep 3, and Friday, Sep 4, 2020. By the end of the trading day on Friday, the declines for the stocks were as follows:

- Google (GOOG): $1,730.28 to 1,590.01 or -8%

- Facebook (FB): $303.13 to $282.63 or -7%

- Slack (WORK): $34.94 to $29.07 or -8%

- Microsoft (MSFT): $232.65 to $214.14 or -8%

- Amazon (AMZN): $3,527.61 to $3,294.62 or -7%

- NetFlix (NFLX): $553.97 to $515.77 or -7%

- Home Depot (HD): $ 287.89 to $269.86 or -6%

- Lowes (LOW): $170.51 tto $156.38 or -8%

- Walmart (WM): $148.29 to $142.84 or -4%

- Johnson and Johnson (JNJ): $155.01 to $148.59 or -4%

- Moderna (MRNA): $68.91 to $62.60 or -9%

- Bank of America (BAC): $26.01 to $26.53 or 2%

What is behind the Dynamics?

AroniSmart Team has conducted Sentiment and Valence analysis and found some interesting insights, including factors related to economic data, such us depression, risks continuing to hang over the market, especially those coming from the upcoming U.S. election, with the potential big changes in tax and other policies spending and income, deterioration of the economy and disproportional impact among the economic classes, the 3 elephants in the room that include China on trade issues, the Federal Reserve policies, and COVID-19.

However, there is positive sentiment, driven by the potentials to weather the storm, strong response to challenges, making a come back and make a kiling, especially with jobs, interest rates, and groundbreaking findings.

More Analytics with AroniSmartInvest™ and AroniSmartIntelligence™

The figures show AroniSmartIntelligence™ sentiment and valence analysis and the last dominance, machine learning resuls, with a sample of Positivity and Negativity words and key stocks. For More, run analyses with AroniSmartIntelligence™ and AroniSmartInvest™.