Investment & Money

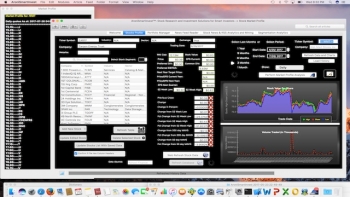

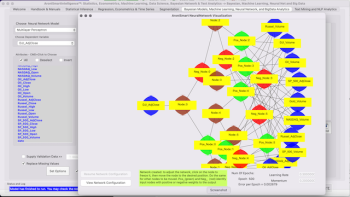

AroniSmartIntelligence Stock Market Indices Time Series Support Vector Machine and Neural Network Analysis

More News

Top Stories

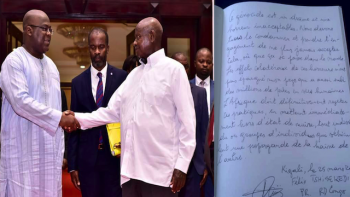

After years of highly publicized trials in Europe, a new judicial case has been opened on allegedly "ill-gotten gains" by the family of Denis Sassou-Nguesso, President of Congo-Brazzaville, in the United States this time. Two Florida federal prosecutors have initiated proceedings last month on the behalf of the United States Department of Justice to seize a luxury property in Florida estimated at close to $ 3 million, which they claim was acquired by Denis Christel Sassou-Nguesso, the son of the Congolese dictator Denis Sassou-Nguesso.

Brig. Gen. Emmanuel Ndahiro (left) cited in Panama Papers and Paradise Papers in Rwandan President Paul Kagame's Confidant

They loot their countries, swim in a sea of wealth and stash funds away from their empoverished homelands, mostly in Western foreign lands, while their people are starving or dying from easily preventable diseases, and their killing squads are brutally murdering those who dare to speak up against corruption, embezzlement and tyranny.

"They" are tyrants and corrupt foreign leaders and their relatives and confidents. They come from all over the World. Africa counts many. After siphoning the economies of their countries, they use the loot to buy mansions, private jets, yachts, rare paintings and artworks, luxury apartments, jewelry, million dollar cars, and other expensive items in the West or hide the money through shell companies.

They loot their countries, swim in a sea of wealth and orgies farther from their homelands, mostly in Western foreign lands, especially the United States, while their people are starving or dying from easily preventable diseases, and their killing squads are brutally murdering those who dare to speak up against corruption, embezzlement and tyranny.

"They" are tyrants and corrupt foreign leaders and their relatives. Some of the most notorious are from Africa. The latest case, involving Samuel Mebiame, the son of the late Gabon Prime Minister Leon Mebiame, highlights the extent of corruption and kleptocracy in Africa.

On Wednesday July 26, 2017, Wal-Mart crossed a major threshold, going above $79.00 for the first time since the announcement of the acquisition of Whole Foods Markets (WFM) by Amazon.

Jet.com, an online retailer startup has agreed to be bought by the retailer giant Wal-Mart in a deal valued at $3.3 billion. Wal-Mart had been trying to break into e-commerce, from its traditional brick-and-mortar retail business for more than a decade. Since 2000, Wal-Mart has been trying to build an on-line presence, with Walmart.com, and hired online executives, such Neil Ashe. It built its own e-commerce to compete against the leaders, especially Amazon. Amazon's growing

Tim Cook sits with CNBC Mad Money Jim Cramer and shares his thoughts on Apple 's Growth and Innovation and Government's Dysfunction

Tim Cook sits with CNBC Mad Money Jim Cramer and shares his thoughts in this video:

African presidents and dictators have started to leave Washington, DC after attending the US - Africa Summit convened by US President Joe Biden. 50 invitees attended, including 49 African top leaders and the leader of African Union. As predicted, the summit focused on the partnership of the US with Africa, security, democracy in Africa, and the rising influence of other world powers, especially China, in Africa. Meanwhile, aside the event, comments by Rwanda's Paul Kagame warning the US leaders against bullying him on the case of Paul Rusesabagina have raised other African leaders' eyebrows.

African presidents and dictators have started to arrive in Washington, DC to attend the US - Africa Summit convened by US President Joe Biden. Close to 50 African leaders are expected in this one of the largest ever gatherings of African leaders in Washington. The latest US - Africa Summit was held in Washington in 2014, convened by forrmer President Barack Obama. The focus will be the partnership of the US with Africa, the deteriorating situation in the Great Lakes of Africa due to the conflict between the Democratic Republic of the Congo (DRC), democracy in Africa, and the rising influence of other world powers, especially China, in Africa.

Making Cents International is inviting youths for The Global Youth Economic Opportunities Summit 2015 in order to provide a demand-driven Knowledge Management (KM) platform to build the capacity of positive youth development stakeholders worldwide to design, implement, and evaluate high-impact youth economic opportunity programs, policies, and partnerships.

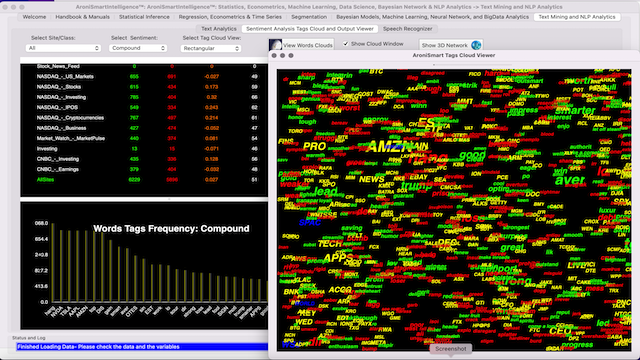

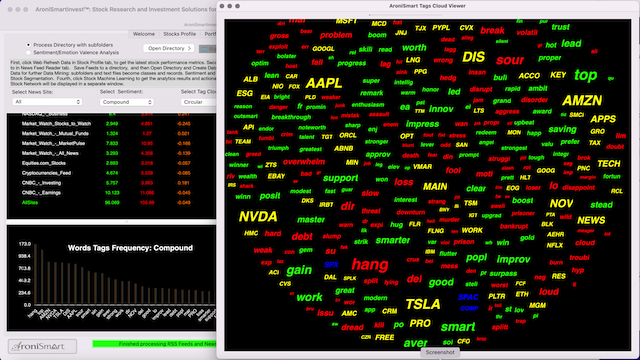

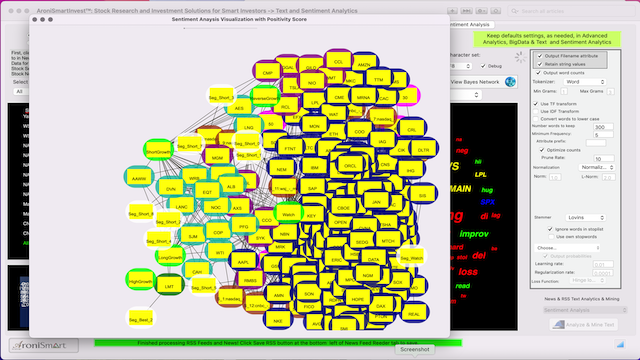

Stocks across all sectors, especially in Tech, Healthcare, Financial Services, Energy, and Consumer have been delivering differential returns over the last years including in 2021, 2022, and Q1- early Q4 2024. Most stocks reached heights in December 2021. Then, in 2022 and up to mid-Q1 2023, the stock growth became broadly negative across most sectors, except energy. The major stock market indices were also impacted. Since then, many stocks across all sectors, along with the key market indices have been on the rise, on a path to reaching the 2021 levels. In a sample of key stocks to watch, as identified by AroniSmart™ team, leveraging the Machine Learning, Econometrics, and NLP capabilities AroniSmartIntelligence™ and AroniSmartInvest™, most stocks have shown resilience and sometimes outperforming most of the other stocks and the key stock market indices. As the end of Q4 2023 is reached , almost all the stocks, along with the key indices have reached highs, even aiming at their record highs.

AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, and Dominance Analysis of AroniSmartIntelligence™ and AroniSmartInvest™, has looked at the trends of the stock prices of 21 selected companies between Q4 2021 and Q4 2023 and came up with insights and projections on the dynamics. This is the Part 2 of the analysis. The findings captured in Part 1 may be seen here: AroniSmartIntelligence™ in Action: Stock Performance Analysis with Sentiment Analysis, Support Vector Machine and Dominance Analysis in Q4 2023 - Part 1.

Part 2 insights are presented below (for disclaimer and terms, check AroniSoft website).

Stocks across sectors, especially in Tech, Healthcare, Financial Services, Energy, and Consumer have been delivering differential returns over the last years including in 2021, 2022, and Q1- early Q4 2024. Most stocks reached their record highs in December 2021. Then in 2022 and up to mid-Q1 2023, stock growth has become broadly negative across most sectors, except energy. The major stock market indices were also impacted. Since then, many stocks across all sectors, along with the key market indices have been on the rise, trying to reach the 2021 levels. A sample of key stocks to watch, as identified by AroniSmart™ team, leveraging the Machine Learning and NLP capabilities of AroniSmartIntelligence™ and AroniSmartInvest™, have shown resilience and sometimes outperforming most of the stocks and the stock market indices.

The stock market lost momentum since December 2021 while the oil industry has gained following the increasing market volatility, inflation, interest rates, world events, and other dynamics. AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, Econometrics, and Dominance Analysis of AroniSmartIntelligence™ and AroniSmartInvest™, has looked at the trends of the stock prices of 21 selected companies between Q4 2021 and Q4 2023 and came up with insights and projections on the dynamics. The insights are presented below (for disclaimer and terms, check AroniSoft website).

Stocks across industries have been experiencing an upward momentum since the beginning of Q3 2023. Some stocks have completely recouped the losses and reached their high levels observed in 2022. Technology, Beverages, and Semi-conductors stocks including Apple Inc. (NYSE: AAPL), Meta (NYSE: META), Nvidia (NYSE: NVDA), Advanced Micro Devices(AMD), Tesla(NYSE :TSLA), The Home Depot (NYSE: HD), Lowes (NYSE: LOW), Pepsi Cola (NYSE: PEP) and Exxon (NYSE: XOM) have been delivering strong returns in Q3 2023, similar to those in the year 2021 and Q1 2022. The oil industry has remained resilient during the period, with Crude Oil (CL=F) and Exxon Mobil Corporation (XOM) around the levels reached in late 2022. Banking and Pharmaceuticals stocks have remained almost flat or experienced some headwinds. The stock market indices have shown similar trends and patterns. The stock market appears to face off the previous increasing market volatility, inflation, world events, and other dynamics since late Q2 2022. AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, and Dominance Analysis of AroniSmartIntelligence™ and AroniSmartInvest™, has looked at the trends of the stock price of AAPL vs the stock prices of 20 selected companies and market indices between Q4 2021 and Q3 2023 and came up with insights and projections on the dynamics. The insights are presented below (for disclaimer and terms, check AroniSoft website).

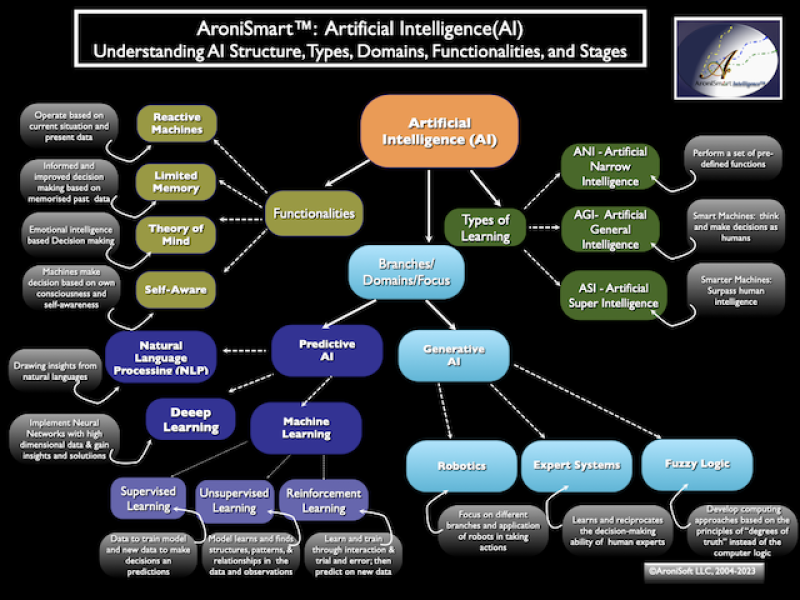

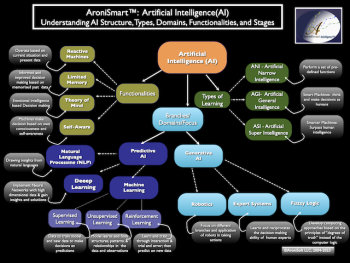

Big Tech Companies have been engaged on the road to Artificial Intelligence. The technology focus have been shifting from Machine Learning to Generative Artificial Intelligence (AI). Some technology companies have been publicly announcing their plans, including hiring engineers, statisticians, mathematicians, designers, and others with a background or interest in Machine Learning but pushing further to Generative AI. The move to Generative AI is a major step in AI itself. As they shape its strategy, advance their plans, achieve their goals, and reach their vision in AI, the expected windfalls are humongous . Already, some companies like META, Apples, and most recently NVIDIA have started to harvest the results.

Stocks across all sectors, especially in Tech, Healthcare, Financial Services, Energy, and Consumer have been delivering differential returns over the last years including in 2021, 2022, and Q1- early Q4 2024. Most stocks reached heights in December 2021. Then, in 2022 and up to mid-Q1 2023, the stock growth became broadly negative across most sectors, except energy. The major stock market indices were also impacted. Since then, many stocks across all sectors, along with the key market indices have been on the rise, on a path to reaching the 2021 levels. In a sample of key stocks to watch, as identified by AroniSmart™ team, leveraging the Machine Learning, Econometrics, and NLP capabilities AroniSmartIntelligence™ and AroniSmartInvest™, most stocks have shown resilience and sometimes outperforming most of the other stocks and the key stock market indices. As the end of Q4 2023 is reached , almost all the stocks, along with the key indices have reached highs, even aiming at their record highs.

AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, and Dominance Analysis of AroniSmartIntelligence™ and AroniSmartInvest™, has looked at the trends of the stock prices of 21 selected companies between Q4 2021 and Q4 2023 and came up with insights and projections on the dynamics. This is the Part 2 of the analysis. The findings captured in Part 1 may be seen here: AroniSmartIntelligence™ in Action: Stock Performance Analysis with Sentiment Analysis, Support Vector Machine and Dominance Analysis in Q4 2023 - Part 1.

Part 2 insights are presented below (for disclaimer and terms, check AroniSoft website).

Stocks across sectors, especially in Tech, Healthcare, Financial Services, Energy, and Consumer have been delivering differential returns over the last years including in 2021, 2022, and Q1- early Q4 2024. Most stocks reached their record highs in December 2021. Then in 2022 and up to mid-Q1 2023, stock growth has become broadly negative across most sectors, except energy. The major stock market indices were also impacted. Since then, many stocks across all sectors, along with the key market indices have been on the rise, trying to reach the 2021 levels. A sample of key stocks to watch, as identified by AroniSmart™ team, leveraging the Machine Learning and NLP capabilities of AroniSmartIntelligence™ and AroniSmartInvest™, have shown resilience and sometimes outperforming most of the stocks and the stock market indices.

The stock market lost momentum since December 2021 while the oil industry has gained following the increasing market volatility, inflation, interest rates, world events, and other dynamics. AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, Econometrics, and Dominance Analysis of AroniSmartIntelligence™ and AroniSmartInvest™, has looked at the trends of the stock prices of 21 selected companies between Q4 2021 and Q4 2023 and came up with insights and projections on the dynamics. The insights are presented below (for disclaimer and terms, check AroniSoft website).