In October 2018, AroniSmartInvest in Action predicted that Twitter’s stock (NASDAQ: TWTR) will have a momentum in Q4 2018. A momentum that was expected to continue over Q1 2019. The latest earnings reports confirm the projections, as Twitter continues to address several areas of concerns.

In Q 4 2018, AroniSmartInvest In Action made the projections after Twitter stock had increased by 86%, reaching $46.80 in July 2018, from $22.04 in January 2018. It was then down 36% over the past three months, back to $28.39. The projections were based on several factors likely to fuel the momentum.

On April 22, 2019, Twitter stock closed at $34.39. At the opening on April 23, 2019 Twitter stock shot up to $38.95, following strong earnings reports for Q1 2019. Twitter adjusted earnings of 37 cents per share on revenue of $787 million topped expectations for earnings of 15 cents per share on sales of $775 million. Its monetized daily average users (mDAU), grew 11% year-over-year to 134 million in the first quarter

Twitter: Security, Mobile, User Engagement, AI and Cost

Hence, the factors that AroniSmartInvest in Action predicted are in action and appear to be supporting a rewarding momentum.

The 134 million mDAU included 105 million mDAU internationally and 28 million in the U.S. In the fourth quarter, average mDAU totaled 126 million globally. In a statement to the media and investors, Twitter attributed the increase in mDAU to “organic growth as well as ongoing product improvements and marketing.”

The Q1 2019 earnings will add fuel the momentum, especially given the strong user engagement. In fact, higher ad impressions and improving clickthrough rates (CTR) improved engagement by 23% in the quarter. The cost per ad engagement decreased by 4% in the same period. At the same time, Twitter has been cleaning abuse content and removing fake accounts, which further increase engagement and security.

One area of concern is the rising cost.

Twitter has reported that the total operating cost grew by 18% in Q1 2019 over Q1 2018. It expects operating expenses to increase by 20% in 2019, due to an increase in headcount and merit salaries, and fixed and variabke costs to on-going efforts to improve platforms and implement new initiatives, such as “existing priorities of health, conversation, revenue product and sales, and platform.”

Advertisement

GET ARONISMARTLYTICS on App Store

AroniSmartLytics, the leading tool for Advanced Analytics

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

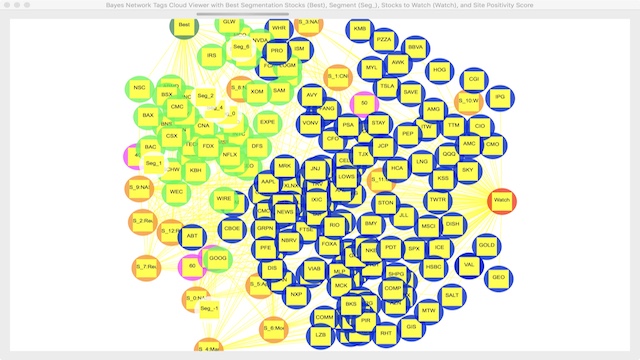

AroniSmartLytics™ is a leading advanced analytics, machine learning and data science tool, with optimized cutting edge statistics models, Big Data and Text Analytics.

AroniSmartLytics™ includes modules covering machine learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.